Audit season is here. And if your business claims fuel tax credits, November and December bring a familiar feeling: the ATO turning up the heat.

More compliance checks. More data-matching. More cross-referencing between what you've claimed and what your business actually does.

But here's what most operators miss: getting audit-ready isn't just about avoiding problems. Done right, it uncovers missed credits, tightens up your numbers, and builds data you'll need anyway for emissions reporting.

Let's walk through how to do this properly.

The ATO Is Watching (And They're Getting Smarter)

The ATO just secured new funding to expand compliance programs. Translation: more audits, better analytics, and much smarter ways to spot inconsistencies.

What does that actually look like? They're now comparing your fuel tax credit claims against:

- Fuel card data from Ampol, BP, Shell, and other providers

- Telematics systems that track where your vehicles actually travel

- Industry benchmarks for businesses like yours

- Your own historical patterns to flag unusual jumps or drops

Here's the scale we're talking about: the FTC program returns over $7.5 billion every year across roughly 300,000 claimants. That's massive. And that level of money naturally attracts serious oversight.

The ATO isn't targeting you specifically. But if your claims don't match observable patterns in your business activity, you're going to get questions.

For larger or more complex operations, it's not if you'll face scrutiny. It's when.

Make Your Claims Defensible (Not Just Accurate)

Every business wants to maximise their FTC entitlements. Fair enough.

But the real goal heading into audit season? Making sure you can defend your numbers with actual evidence.

Start here: pull your last three months of fleet data. Look at how much time vehicles spend on-road versus off-road. Now compare that to the split you're claiming on your BAS.

If the difference is more than 10%, you've got a problem.

Here's what defensible actually means:

Imagine an ATO auditor asks: "You've claimed 40% of your diesel as off-road, but your GPS shows vehicles on public roads 65% of the time. Explain that."

Can you? If your answer involves shrugging or referencing estimates from three years ago, you're not ready.

The upside of better data

Tighter fuel tracking doesn't just protect you in audits. It shows you where fuel actually gets used, where you're wasting money, and where your costing assumptions are off.

A lot of businesses discover that installing telematics or GPS systems pays for itself in two ways: it finds missed FTC claims and it cuts out operational waste.

You're not choosing between compliance and opportunity here. Good data delivers both.

Real Example: How One Operator Found $50k in Missed Credits

Let's talk about a regional transport and waste company. Real case, real numbers.

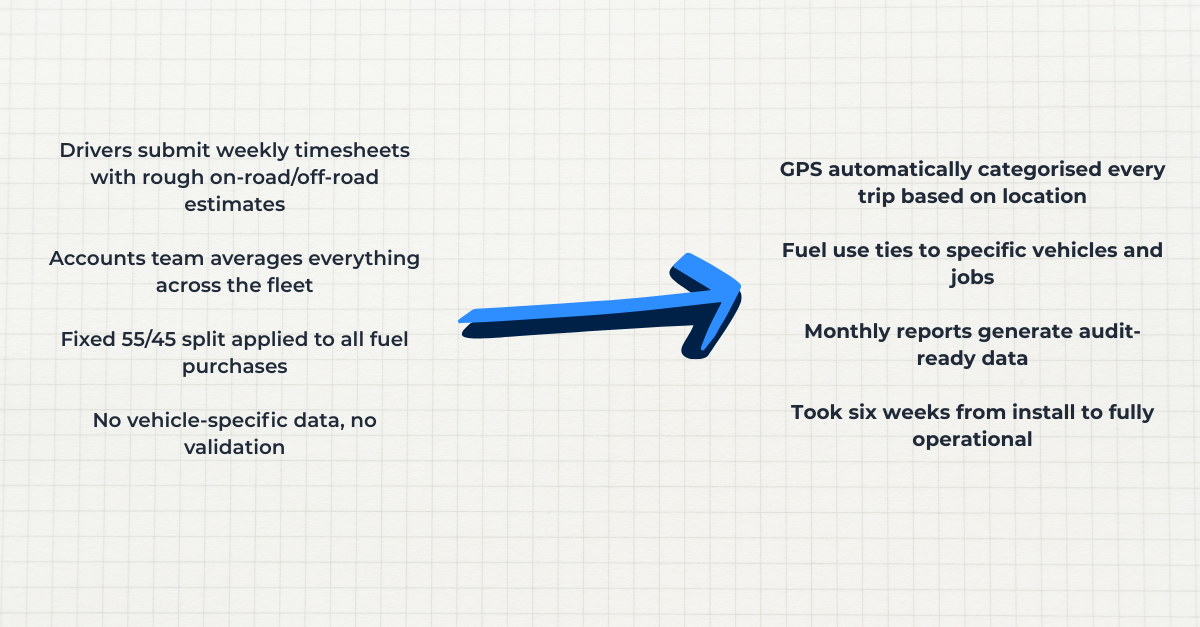

For years, they did FTC manually. Drivers guessed how much time they spent on private sites versus public roads. Someone in accounts averaged those guesses, applied a fixed percentage split to all diesel purchases, and lodged the claim.

It worked. Sort of. But it left gaps.

Their old practice:

The result? They found over $50,000 in previously unclaimed credits. Most of it came from equipment that worked almost entirely off-road but had been lumped into fleet-wide averages.

Eight months later, the ATO reviewed their claims.

The audit took two days. They handed over verified GPS data, a clear trail from purchase to claim, and proof of quarterly reviews. No stress. No scrambling. No weeks of back-and-forth.

When your data tells a clear story, there's nothing to defend.

Three Red Flags the ATO Always Notice

Some patterns trigger ATO review more than others. Here are the big three:

- Your Ratios Never Change

If your business had grown, shifted operations, or changed routes but your FTC percentages stay exactly the same year after year, that's a flag.

Quick test: Did your revenue grow 30% and your FTC claim also grow 30%? You're using a static ratio that doesn't reflect real operations anymore.

The fix: Review actual usage quarterly and update your split to match current activity.

- Your Records are Weak

Invoices alone won't cut it. The ATO expects you to connect fuel purchases to specific activities.

What good record-keeping looks like:

- Fuel invoices with date, supplier litres

- Vehicle or equipment ID for each purchase

- Activity logs showing on-road and off-road for the same period

- Documentation of how you calculated your split

- Regular sign-offs by someone accountable

Generic statement like "our trucks work off-road about half the time" don't hold up.

- You Don't Fix Mistakes When You Find Them

Discovered an error in a past claim? The ATO expects you to correct it in your next BAS. Overstated Q2 by $5,000? Adjust down in Q3. Understated? Claim the extra. Either way, document what happened and why.

Businesses that fix their own mistakes fare way better than those who wait for the ATO to find problems.

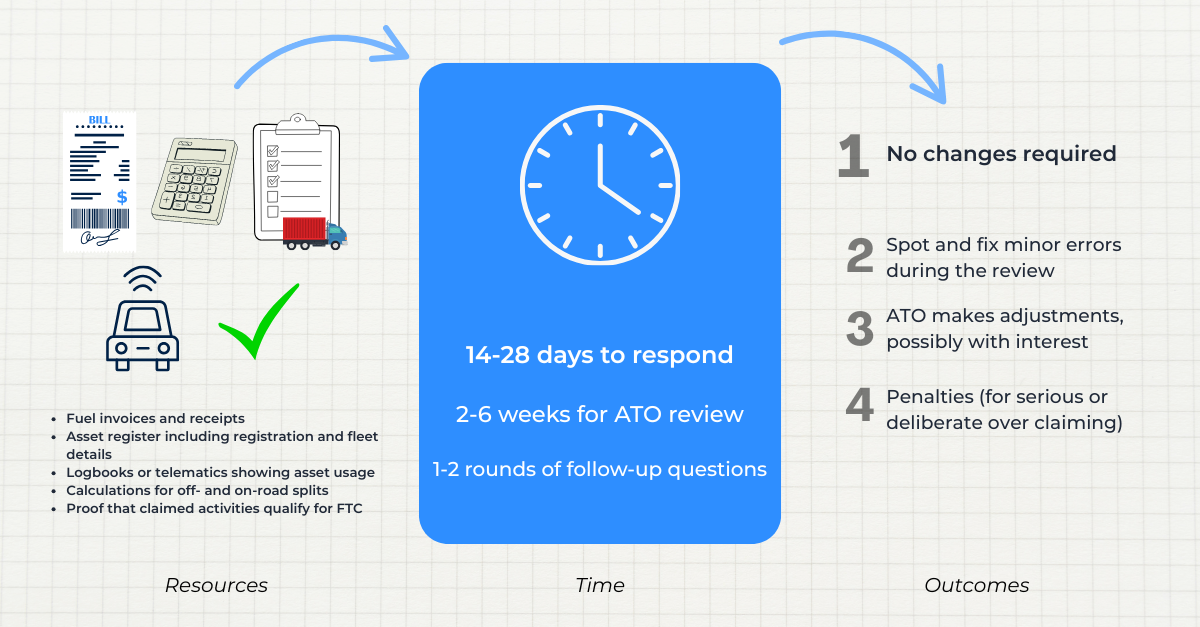

What Actually Happens in an ATO Audit

Most of the fear around audits comes from not knowing what to expect. Let's demystify it.

Most audits end with minor tweaks or no changes at all. THe ones that go badly? Poor record keeping and indefensible methods.

Your Fuel Data Does Double Duty (Tax + Carbon)

Here's something most businesses haven't connected yet: the same data that backs your FTC claims can power your emissions reporting.

Every litre of diesel = 2.7kg of CO2.

If your FTC tracking shows 100,000 litres of off-road use, that's 270 tonnes of emissions you can now measure, report and reduce.

Where this matters:

- NGER reporting

- Carbon budgeting by department or project

- Fleet transition planning (which vehicles should we electrify first?)

- ESG reporting for investors and customers who want real data, not estimates

Some operators are already running a single data workflow that serves both ta compliance and sustainability goals. It's smart. You're tracking fuel anyway. With a bit more detail, that same data meets environmental expectations too.

This is quickly becoming an competitive advantage. Regulators want accurate tax reporting. Investors want credible emissions data. Customers prefer supplier who can provide environmental responsibility.

One good dataset. Three valuable outputs.

Your Audit-Readiness Checklist

Here's what to do before the ATO comes knocking. Specific actions, realistic timeframes.

| Task | Time Estimate | Steps |

|---|---|---|

| Review Your Apportionment Method | 2–3 hours | - Pull 3 months of actual fleet activity- Compare on-road vs off-road time to your current FTC split- Variance over 10%? Update your methods- Document what changed and why |

| Confirm Your FTC Rates | 30 minutes | - FTC rates change multiple times a year, sometimes mid-month- Check ATO published rates for each BAS period you're claiming- Don’t assume consistency between periods |

| Organise Your Documents | 1–2 hours | - Gather fuel invoices, receipts and fuel card statements- Link every purchase to a vehicle or equipment ID- Organise by BAS period so you can find things fast- Create a simple index |

| Align Your Telematics Reports | 1–2 hours | - Export usage data that matches your BAS claim dates exactly- Check that on-road/off-road definitions are consistent- Look for gaps or weird anomalies- Reconcile telematics with actual fuel purchases |

| Run Your Own Internal Audit | 3–4 hours | - Pick one quarter as a test- Pretend the ATO just asked for evidence- Can you substantiate every dollar claimed?- Find your weak spots before they do |

Total time = 8-12 hours.

Less than two days of work to potentially save weeks of audit stress and recover thousands in missed credits.

The Bottom Line

Audit season doesn't have to feel like an ambush.

The businesses that handle ATO scrutiny well aren't the ones with the fanciest systems or biggest compliance budgets. They're the ones who understand their actual fuel use, keep clear records, and can back up their number with real data.

Do this now: review your methods, get your documents in order, run your own audit before the ATO does.

Two days of work now could save you months of headaches later. And you might find money you didn't know you were missing.

That's not just good compliance. It's good business.